For tax purposes the value of stock in tradewhich is taken into account in determining the adjusted income is ascertained in accordance with section 35 of the ITA. The value of the s.

Tax And Investments In Malaysia Crowe Malaysia Plt

When is the gain income and when is it capital.

. If you invest in forex trading be ready to remit income taxes except for forex capital gains exempted. In Malaysia only income is subject to tax. JayC 1302 posts Posted by JayC 2019-03-17 2026 Report Abuse.

As far as I know there will be no tax if your main source of income is not coming from stock trading. A brokers online trading platform should let you enter orders and receive confirmations on your stock orders in addition to providing access to accurate stock quotes. As a Malaysian citizen you do not pay tax on any capital gains made from.

In many developed countries capital gains tax is imposed on gains from the stock market. I am currently unemployed and mainly trade stocks forex and options to earn some incomeforesee will continue to do so for the rest of the year. Under the Malaysian Income Tax Act 1967 the government does not impose a tax on any profits or gains deriving from any price increase when you sell a stock.

Capital gains on shares are not taxed. Any capital gains on shares are not subject to tax under the Malaysian Income Tax Act 1967 ITA. Tax Advantages Capital Gains Tax Firstly there are tax advantages of investing in Bursa Malaysia.

However if the activity of trading in shares is frequent enough the Malaysian. Open a trading account in the country where the respective stocks originate from. Is Forex Stock Trading Taxable in Malaysia.

Is forex trading taxable in Malaysia 2020 price list price today is forex trading taxable in Malaysia 2020. Pasaje Hernán Velarde 188. For one higher volumes will trading bitcoin for stock taxable Malaysia allow users to easily buy or sell the cryptocurrency of their choice without much difficulty because of the available liquidity.

Generally income taxable under the Income Tax Act 1967 ITA 1967 is income derived from Malaysia such as business or employment income. Use a foreign broker. The taxable value of RSU restricted stock is the market value of the shares on the date of vesting less the amount paid for the shares if any.

However Forex capital gains are exempt from tax. Taxation on Forex trading in Malaysia Forex income is indeed taxable in Malaysia and is seen as income tax. Capital gain from stocks investment is not taxable in Malaysia but heres what you do which can cause it to be taxable.

Capital gains arising from stock trading activities including ESOS are also not liable for income tax payments in Malaysia. In Malaysia taxable capital gains are those resulting from the sale and purchase of real. For instance if you want to invest in an American company.

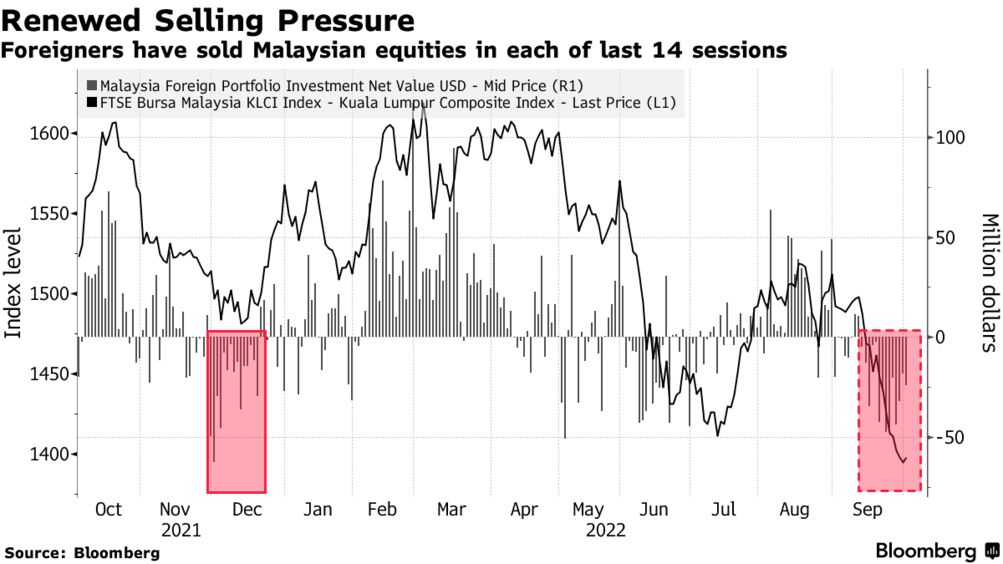

What this means is if an. Advantages of Investing in Bursa Malaysia. 4 hours agoThat in turn has dragged yields on government bonds.

Trading Di Lungo Termine. Malaysia has some of the most beneficial trading tax laws in Asia. Yes its true one prominent stocks.

Yes it is. After that you should understand that all forex traders in. I would like to know whether I.

In many developed countries. So is stock trading taxable in malaysia bitcoin profit stop loss and take profit calculator better. During World War II Templeton made a pile for his.

Because they are capital gains stock investment gains are tax-free Capital Gain Tax.

Everything You Need To Know About Forex Trading In Malaysia Daily News Hungary

Tax For The 6 Common Investments In Malaysia Smart Investor Malaysia

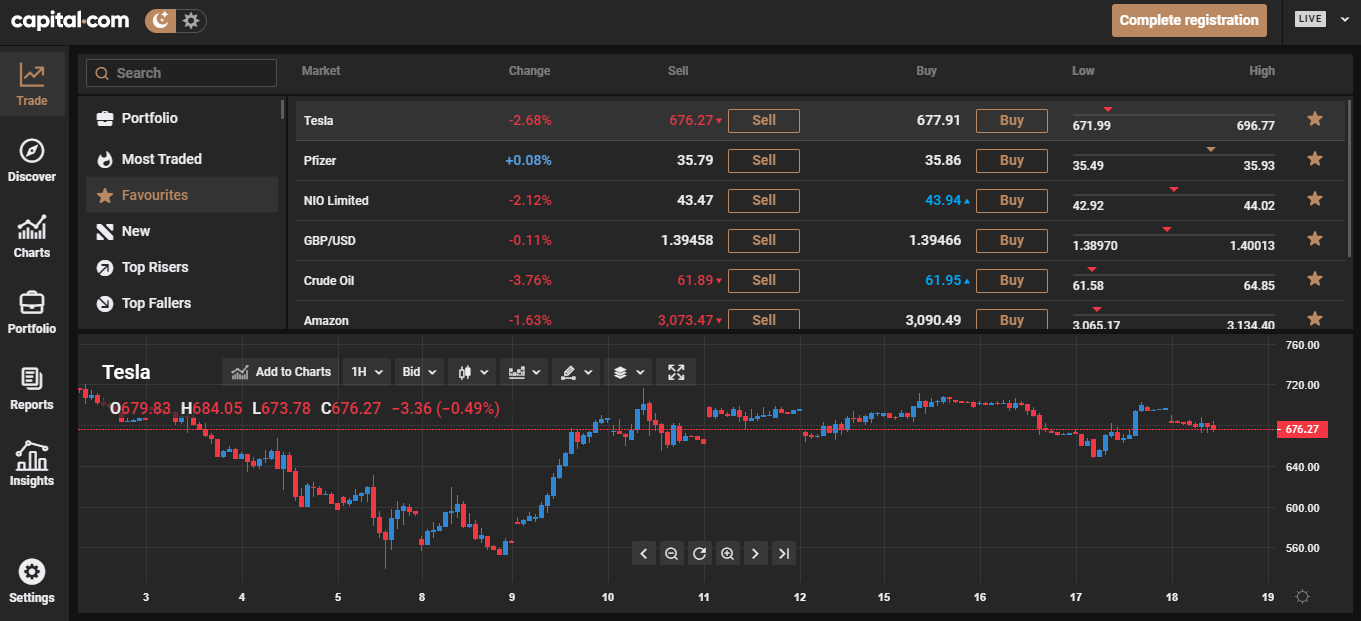

Best Trading Platforms 2022 Trading Sites Review Tradingplatforms Com

Forex Trading In Malaysia Forex Malaysia

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy

Malaysia Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

The Best Capital Gains Free Countries For Forex Trading Business Review

Is Stock Trading Taxable In Malaysia Savannagwf

Malaysia Economic Transformation Advances Oil Palm Industry

China Sales Tax Rate Vat 2022 Data 2023 Forecast 2006 2021 Historical Chart

First Mover Asia Malaysia May Be Asia S Next Crypto Hub Major Cryptos Decline As Russia Onslaught Intensifies

Malaysia S Upcoming Budget Will Bolster Consumer Stocks Bloomberg

Investing Making It Easier To Invest In Foreign Stocks The Edge Markets

Financial Transaction Tax Analysis Of A Financial Transactions Tax Ftt

International U S Energy Information Administration Eia

Can A Foreigner Open A U S Trading Account How To Buy Us Stocks For Non Residents Non U S Citizens