Lets say your salary Basic Salary Dearness Allowance Rs 50000 per month. A point to note here is that the exemption for conveyance allowance can be grouped with some other allowances for.

Tax Benefits On Epf Employer Employee Contribution Impact Of Withdrawal Before 5 Years Saving For Retirement Facts Money Today

There are three scenarios upon which 100 of the EPF can be withdrawn.

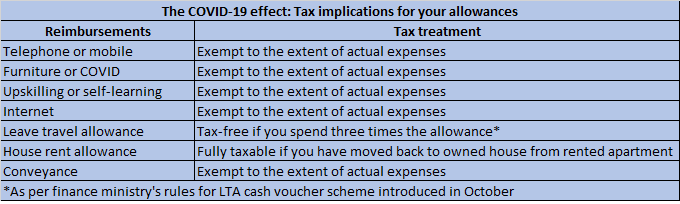

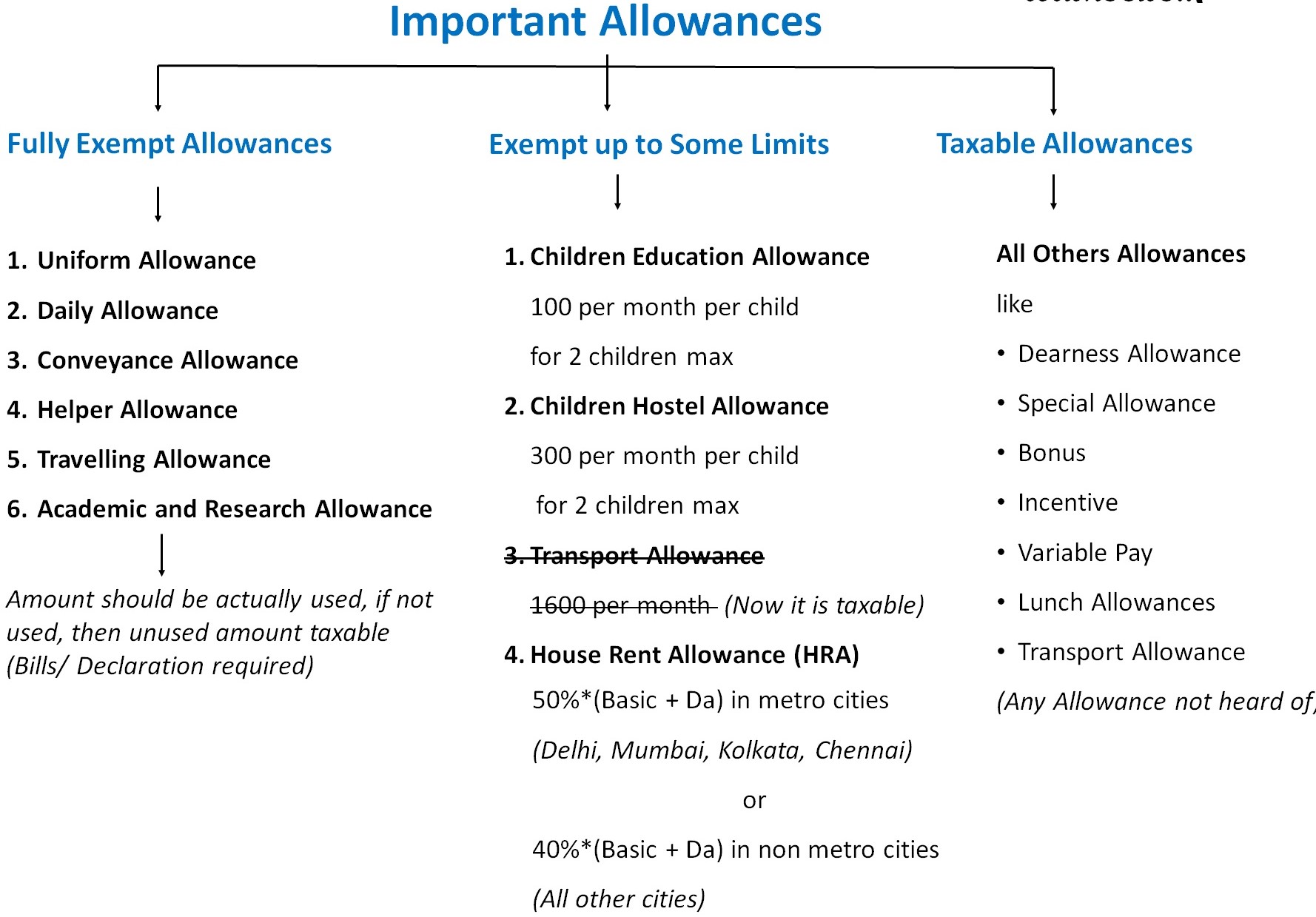

. Further while fixed amount of transport allowance is exempt irrespective of actual expenditure conveyance allowance only to the extent of actual expenditure incurred is exempt from tax. This means that no tax is. With effect from the financial year 2018-2019 the tax exemption for transport allowance and medical allowance have been merged.

Here is how you can report tax-exempt incomes in your ITR-1. The employer deducts 12 of the employees salary basic dearness allowance directly every month for a contribution towards EPF. The investment in the EPF Scheme gets a tax deduction up to a maximum of Rs 15 lakh per year under opt-out Section 80C of the Income Tax Act 1961.

Some portion of the employees salary goes towards the EPF fund every month. The employee contributes 12 of basic salary plus dearness allowance DA towards its EPF account. There are no complicated calculations involved in calculating conveyance allowance limit.

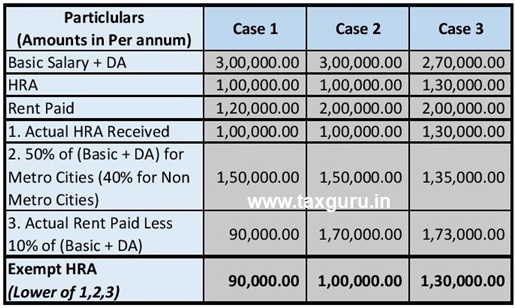

If you are a salaried employee living on rent then heres how you can use HRA to reduce your tax. If your annual contribution to the EPF account exceeds Rs 25 lacs or Rs 5 lacs as the case may be then the excess portion goes to this account. Under section 45 of the Employees Provident Fund Act 1991 EPF Act employers are statutorily required to contribute to the Employees Provident Fund commonly known as the EPF a social security fund established under the EPF Act to provide retirement benefits to employees working in the private sector.

Tax on Returns. B Any income derived from such land. House rent allowance HRA is a basic component of your salary.

How to Calculate Conveyance Allowance. There is no upper limit defined for special allowance. The principle amount and the accrued interest are exempt from income tax during withdrawal and thus an attractive retirement plan for the salaried class.

Tax deducted at source TDS is deducted on the premature withdrawal only if the amount exceeds Rs. Agricultural income is defined under section 21A of the Income-tax Act. The employer contribution is exempt from tax and employees contribution is taxable but eligible for deduction under section 80C of Income-tax Act.

RPF under the Employees Provident Fund Act. As per section 101 agricultural income earned by the taxpayer in India is exempt from tax. Members can avail a non-refundable withdrawal of up to 75 of the amount available in their EPF account or 3 months of their basic wages and dearness allowance whichever is lower.

Now following are the contributions made by you employee and the employer. Do the calculation of EPF and EPS contribution if the employees basic monthly salary is Rs 52263 and verify it. 25 Lakh in a financial year then the interest earned on the contributions above Rs.

But this rate is revised every year. As per section 21A agricultural income generally means. The extent of the employers obligation to.

CTC basic salary gross salary allowance reimbursements tax deductions provident fund etc. 25 Lakh will be taxable. The HRA received is INR 15000.

The employee has to contribute a lower contribution of 10 in case the entity has less. It is difficult to understand all the terms associated with salary. Employees contribution to the EPF account is eligible for deduction under Section 80C.

However you have to declare PPF returns in your income tax return each year. Investments in EPF is a profitable venture for salaried employees because of its exempt-exempt-exempt model. This fund falls under the EEE Exempt-Exempt-Exempt taxation regime.

Exempt-Exempt-Exempt category of savings products. Interest earned in this account is exempt from tax. Special Allowance is an allowance that is paid to an employee to meet specific work-related expenses and does not fall into any other allowance category.

As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. This continuity and a generous interest rate make EPF an excellent retirement tool. This entire contribution goes to the EPF account of the employee.

Furthermore EPFO is set to settle these withdrawal claims within 3 days and has also created an auto-claim settlement process for members whose KYC is complete in. 2 Non-Taxable EPF Contribution Account. However in Budget 2021 the government has announced that starting FY22 if the deposits in EPF and VPF Voluntary Provident Fund exceed Rs.

The money withdrawn from EPF accounts can be exempt from tax under certain conditions. In this blog we have attempted to simplify these terms for you. 1st E investments in EPF up to Rs 15 lac per year eligible for.

The HRA is exempt from taxation under Section 10 of the Income Tax Act of 1961 and there are two ways to claim it. The contributions made in EPF are tax exempt. The contributions towards EPF are made equally by the employer and the employee.

Taxation on EPF withdrawal. Let us understand this with an example. Ms Shresta lives in Mumbai and the basic salary she receives is INR 30000.

On top of it EPF taxation comes under the exempt-exempt-exempt EEE category which means the maturity amount will not attract any capital gains. Interest earned in this account is taxable. Employers contribution is also tax free but it is not eligible for deduction under.

Whereas in the case of employees of a private organisation it is exempt subject to certain conditions. Provident Fund or EPF comes under the E-E-E or Exempt-Exempt-Exempt category of savings products. However PF withdrawal is taxable for less than 5 years of service.

For the financial year 2018-2019 the standard deduction was Rs 40000. The limits are absolute at Rs1600 per month or Rs19200 per year irrespective of the tax bracket an individual falls into. In the case of EPF the taxpayer can withdraw the balance subject to a few conditions.

It falls under the EEE exempt exempt exempt category where the accrued interest and the. There should be no break in the 5 years. Conveyance allowance is an allowance granted to meet the expenditure on conveyance in performance of office duty.

A Any rent or revenue derived from land which is situated in India and is used for agricultural purposes. Under E-E-E model investments interests withdrawals after 5 years are. Gratuity received by a government employee is totally exempt from tax.

PPF returns are exempt from tax. If you have withdrawn money from your EPF account then you are required to report the same by selecting - Section 1012 Recognised Provident Fund from the drop-down menu. The Dearness Allowance is INR 30000.

As of now the EPF interest rate is 850 FY 2019-20. 100000 would be exempt as the house rent allowance tax from Shivams salary. EPF deposits and interest were completely exempt from tax until the year 2020.

However most of us are not familiar about the rules that can help us save tax on it. Since she lives in a metro city the HRA amount that is exempt from tax is INR 9000 and taxable HRA is 6000. The rent that she pays is INR 15000.

Contribution period must be over 5 years. 4 Employees Provident Fund EPF. It is exempt from tax up to the extent of the actual expenditure incurred for carrying out duties in an office.

The Income Tax Department introduced a standard deduction in place of the exemption for transport allowance and medical allowance.

All About Allowances Income Tax Exemption Ca Rajput Jain

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Post Budget Tax Math Should You Shift From Epf To Nps Now Mint

![]()

What Is Ctc Cost To Company Meaning Akrivia Hcm

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Leaving India To Become An Nri Here S What You Do With Your Pf Account

Work From Home Here Is How Reimbursements And Allowances Will Be Taxed

Download Gratuity Calculator India Excel Template Msofficegeek Payroll Template Excel Templates Dearness Allowance

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

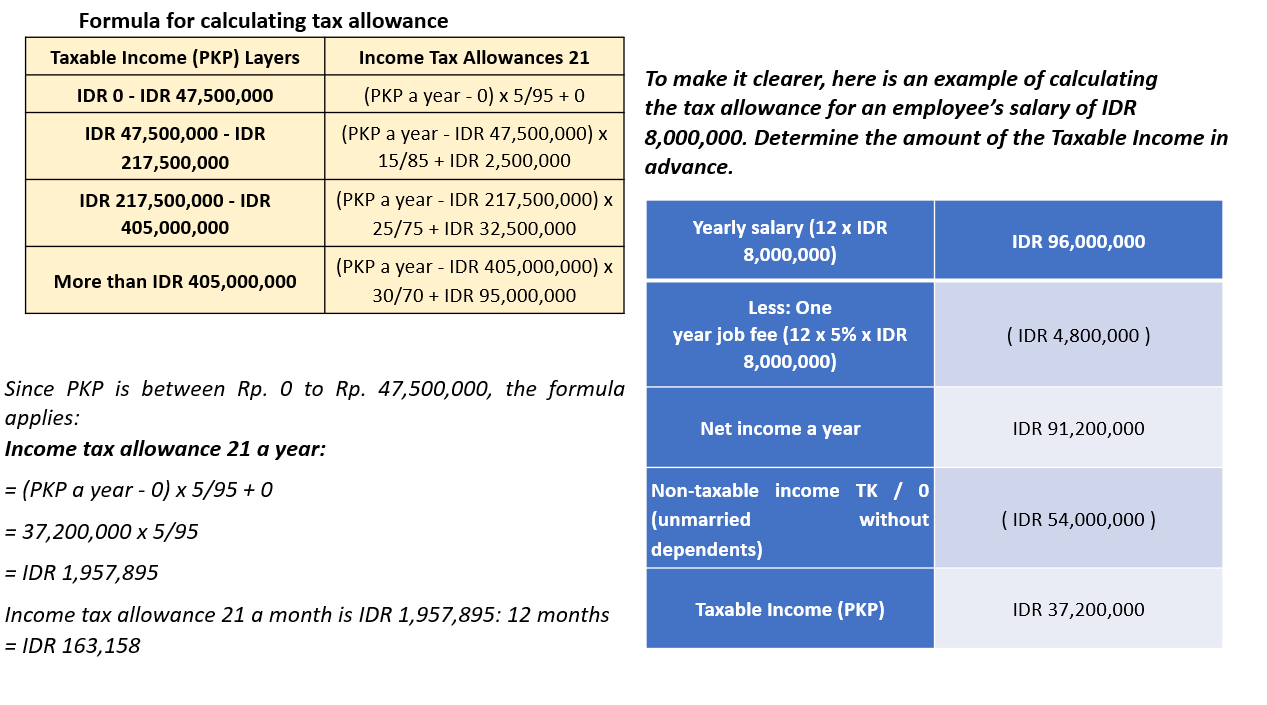

Indonesia Payroll And Tax Guide

All About Allowances Income Tax Exemption Ca Rajput Jain

Income Tax Allowances And Deductions For Salaried Employees

Salary Segments That Can Reduce Employees Tax Liabilities Sag Infotech Salary Segmentation Tuition Fees

Allowances Exempt From Tax For Salaried Person Most Useful Planmoneytax

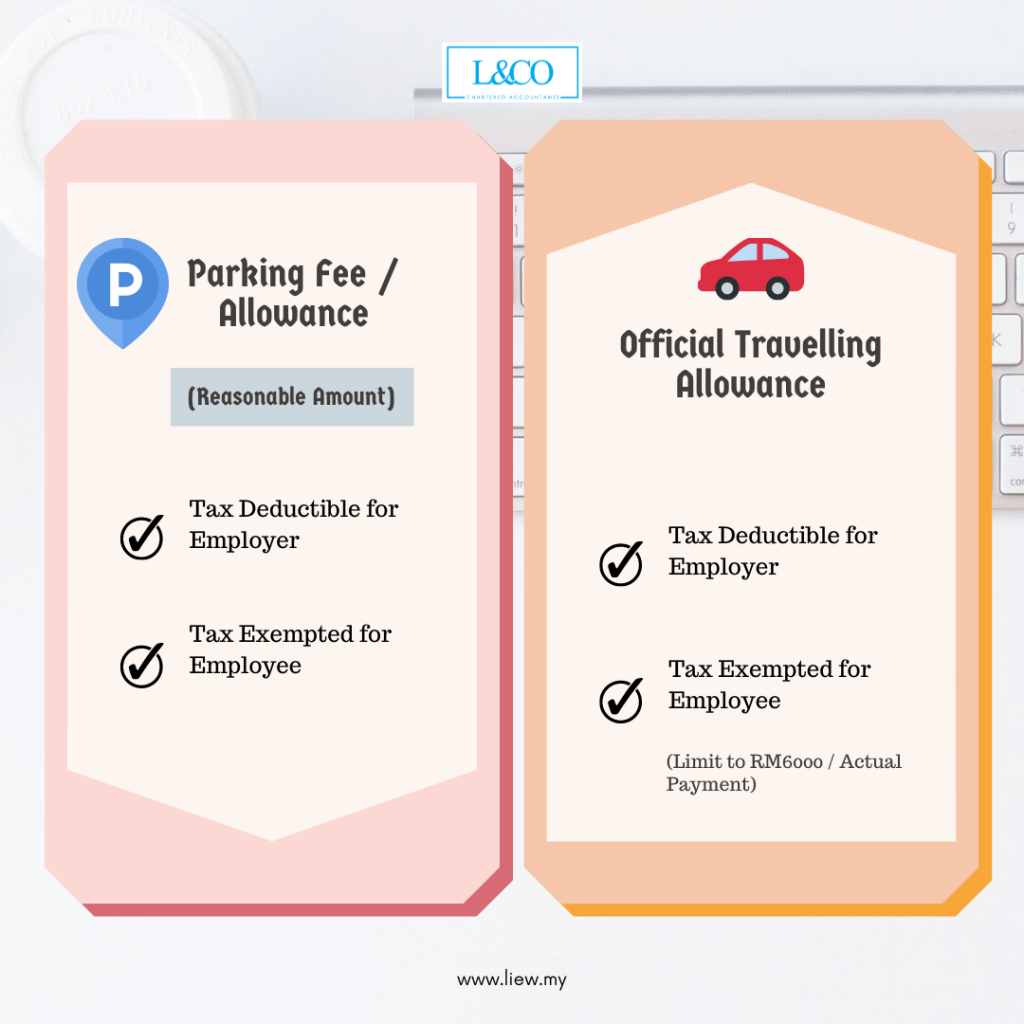

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co